Top 10 Best RBI Approved Loan Apps in India (2024): A Comprehensive Guide to Fast, Secure Borrowing

Need a fast, secure loan in India? Explore the top 10 Best RBI Approved Loan Apps in India 2024. Compare features, eligibility, and responsible borrowing tips for a stress-free experience.

Top 10 Best RBI Approved Loan Apps in India (2024): A Comprehensive Guide to Fast, Secure Borrowing

The financial landscape in India is evolving rapidly, and with it, the way people access credit. Gone are the days of lengthy bank visits and cumbersome paperwork. Today, Best RBI Approved Loan Apps in India offer a convenient and secure solution for your immediate financial needs. But with a plethora of options available, navigating this space can be overwhelming.

This in-depth guide empowers you to make informed decisions. We’ll delve into the Best RBI Approved Loan Apps in India, exploring their features, eligibility criteria, application processes, and responsible borrowing practices.

Why Choose Best RBI Approved Loan Apps in India ? Building Trust and Security

Not all loan apps are created equal. While some prioritize ethical practices and transparency, others might engage in predatory lending. This is where the RBI (Reserve Bank of India) approval comes in as a crucial safeguard. Here’s why opting for Best RBI Approved Loan Apps in India is the smarter choice:

- Strict Regulatory Compliance: RBI approval signifies adherence to stringent regulations. These regulations ensure fair lending practices, transparent interest rates, and a commitment to data security.

“Choosing an Best RBI Approved Loan Apps in India is like having a trusted financial partner,” says financial advisor Meena Iyer. “It provides peace of mind knowing your information is protected and you’re not dealing with a fly-by-night lender.”

- Transparency Throughout the Process: Best RBI Approved Loan Apps in India offer clear loan terms, interest rates, and repayment schedules upfront. There are no hidden fees or surprises lurking around the corner.

- Consumer Protection Mechanisms: RBI regulations provide a safety net for borrowers. In case of disputes, you have recourse and can seek assistance from regulatory bodies.

- Enhanced Data Security: Best RBI Approved Loan Apps in India implement robust security measures to protect your personal and financial information. This includes data encryption and adherence to data privacy regulations.

By choosing Best RBI Approved Loan Apps in India, you prioritize security, transparency, and a fair borrowing experience.

Also Read : Unveiling Fake Loan Apps: Spot and Avoid Financial Scams!

Top 10 RBI-Approved Loan Apps in India (2024): Unveiling the Best Options

Now, let’s delve into the top contenders in the Best RBI Approved Loan Apps in India category. We’ll explore their unique offerings and highlight factors to consider when making your choice.

PaySense: A Champion for Quick and Hassle-Free Loans

Ideal for: Individuals seeking quick and convenient personal loans for urgent needs.

Loan Range: ₹5,000 – ₹5,00,000

Key Features:

- Fast Approvals: PaySense boasts a reputation for speedy loan approvals, often within minutes of application submission.

- Minimal Documentation: You won’t need a mountain of paperwork. Aadhaar card, PAN card, and bank statements typically suffice.

- Competitive Interest Rates: PaySense offers competitive interest rates compared to some unapproved lenders.

Things to Consider: Interest rates can vary depending on your creditworthiness. Learn more

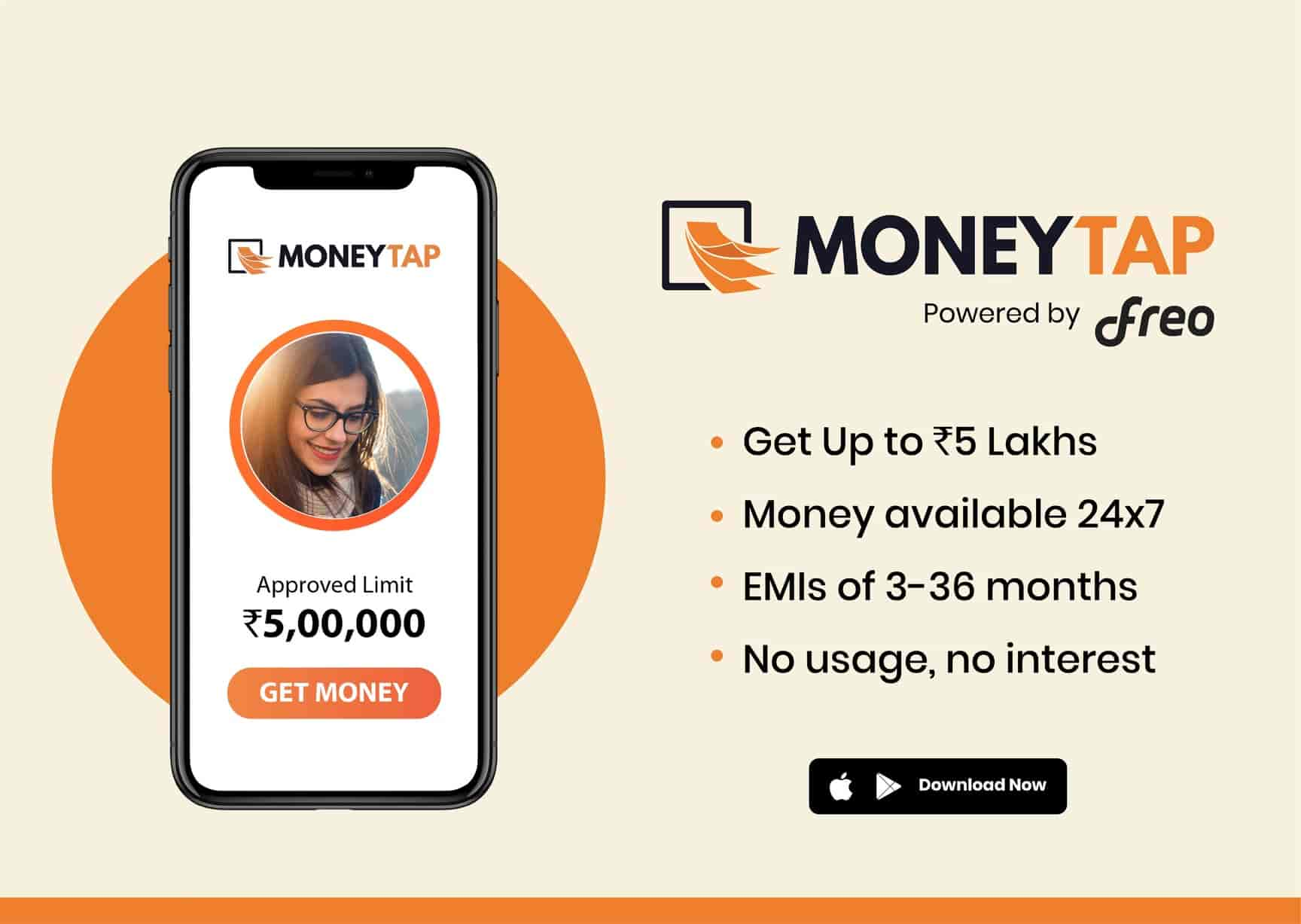

MoneyTap: Simplifying the Process with a Digital-First Approach

Ideal for: Tech-savvy individuals who value a seamless digital experience.

Loan Range: ₹3,000 – ₹5,00,000

Key Features:

- Paperless Processing: Say goodbye to physical paperwork! MoneyTap offers a completely paperless loan application process.

- User-Friendly Interface: Their app is designed for intuitive navigation, making it easy to apply for and manage your loan.

- Secured API: MoneyTap prioritizes data security with a secure API (Application Programming Interface) that protects your information.

Things to Consider: While convenient, the app-based platform might not be ideal for those less comfortable with technology.

Dhani: Instant Gratification with Minimal Paperwork

Ideal for: Individuals seeking instant personal loans with a straightforward application process.

Loan Range: ₹1,000 – ₹5,00,000

Key Features:

- Instant Approvals: Dhani lives up to its name, offering instant loan approvals upon successful application.

- Minimal Paperwork: Similar to PaySense, Dhani keeps the documentation requirements to a minimum.

- Cashback Rewards: Dhani incentivizes borrowing with an attractive cashback rewards program on loan amounts.

Things to Consider: Interest rates might be slightly higher compared to some competitors. Learn more

NIRA Finance: A Strong Contender with Competitive Rates and Speed

Loan Range: ₹3,000 – ₹5,00,000

Key Features:

- Competitive Interest Rates: NIRA Finance offers attractive interest rates compared to some other Best RBI Approved Loan Apps in India.

- Quick Approvals: While not quite instant, NIRA’s approval process is known for its efficiency, often taking just a few hours.

- Customer Service Support: A dedicated customer service team is available to address your queries and concerns.

Things to Consider: The loan amount limit might be lower for first-time borrowers compared to established users. Learn more

CASHe: Innovation and Customer Focus Define the Experience

Ideal for: Individuals seeking a loan app with a focus on user experience and innovative features.

Loan Range: ₹5,000 – ₹5,00,000

Key Features:

- Online Application Process: The entire loan application journey, from submission to approval, can be completed online.

- Privacy & Security Features: CASHe prioritizes data privacy and employs robust security measures to protect user information.

- 24/7 Customer Service: They offer round-the-clock customer support for any assistance you might need.

Things to Consider: Interest rates might be on the higher end compared to some competitors with stricter eligibility criteria. Learn more

NAVI: Streamlined Application for Larger Loan Amounts

Ideal for: Individuals seeking larger loan amounts for personal needs or debt consolidation.

Loan Range: ₹3,000 – ₹20,00,000 (Significantly higher limit compared to most apps)

Key Features:

- Paperless Application: NAVI offers a completely paperless application process, making it convenient and efficient.

- Quick Disbursal: Upon loan approval, the funds are disbursed quickly into your bank account.

- Transparent Terms: NAVI prioritizes transparency by clearly outlining all loan terms and conditions upfront.

Things to Consider: Eligibility criteria might be stricter for larger loan amounts, often requiring a higher credit score.Learn more

Bajaj Finserv Markets: A Trusted Legacy in Digital Lending

Ideal for: Individuals seeking a reliable option backed by the established Bajaj Finserv brand.

Loan Range: Varies depending on loan type (personal loans typically range from ₹3,000 – ₹25,00,000)

Key Features:

- Wide Range of Loan Products: Bajaj Finserv Markets offers various loan options beyond personal loans, catering to diverse needs.

- Experienced Lender: Backed by the Bajaj Finserv legacy, they bring experience and trust to the digital lending space.

- Flexible Repayment Options: Bajaj Finserv Markets provides borrowers with flexible repayment options to manage their loans comfortably.

Things to Consider: The loan application process might involve slightly more documentation compared to some other apps on this list. Learn more

ZestMoney: Expanding Beyond Loans with Credit Management Tools

Ideal for: Individuals seeking a loan app that goes beyond just providing funds and offers credit management tools.

Loan Range: Up to ₹5,00,000 for personal loans

Key Features:

- EMI Financing: ZestMoney offers EMI financing options for online purchases, allowing you to spread the cost over time.

- Credit Score Improvement Features: The app provides tools and resources to help borrowers track and improve their credit score.

- Variety of Loan Products: ZestMoney offers various loan options besides personal loans, catering to specific needs like shopping or travel.

Things to Consider: The eligibility criteria might be stricter for individuals with a limited credit history. Learn more

IndiaLends: A Marketplace Approach to Find the Right Loan

Ideal for: Individuals who prefer to compare options before committing and value a curated selection of lenders.

Loan Range: Varies depending on the chosen lender (typically ranges from ₹5,000 – ₹25,00,000)

Key Features:

- Loan Comparison Platform: IndiaLends acts as a marketplace, allowing you to compare loan offers from multiple RBI-approved lenders.

- Free Credit Report Access: IndiaLends provides users with free access to their credit reports, empowering informed decisions.

- Streamlined Application Process: Once you choose a lender, the application process is typically streamlined and efficient.

Things to Consider: The initial step involves choosing a lender from the marketplace, which might require additional research for some users. Learn more

True Balance: Microloans and Financial Literacy Resources

Ideal for: Individuals seeking smaller loan amounts or those who want to build their credit history with a microloan.

Loan Range: Typically offers microloans ranging from ₹500 – ₹50,000

Key Features:

- Microloan Focus: True Balance caters to those seeking smaller loan amounts, making it suitable for urgent, short-term needs.

- Financial Literacy Resources: True Balance goes beyond just lending by offering educational resources to promote financial literacy.

- Building Credit History: Microloans from True Balance can be a stepping stone for individuals with limited credit history to build a positive credit score.

Things to Consider: The loan term for microloans is typically shorter compared to personal loans offered by other apps. Learn more

Beyond the Top 10: Exploring Additional Best RBI Approved Loan Apps in India Options

Remember, the Best RBI Approved Loan Apps in India landscape is constantly evolving. Here are some additional options you might consider:

- Flipkart Finance: Backed by the e-commerce giant Flipkart, this app offers loan options for online purchases.

- Amazon Pay Later: Similar to Flipkart Finance, Amazon Pay Later provides financing options for purchases made on the Amazon platform.

- MobiKwik Zip Pay: This digital wallet offers a “Zip Pay” feature that allows users to avail of short-term loans.

- PhonePe: The popular digital payments platform PhonePe also offers loan options through partnerships with RBI-approved lenders.

Demystifying the Application Process: A Step-by-Step Guide

Applying for a loan through an Best RBI Approved Loan Apps in India is a streamlined process. Here’s a breakdown of the typical steps involved:

- Download the App: Find your preferred Best RBI Approved Loan Apps in India on the App Store or Google Play Store.

- Register and Verify: Create an account within the app by providing basic details and completing the KYC (Know Your Customer) verification process. This usually involves uploading scanned copies of your Aadhaar card and PAN card.

- Fill Out the Application: Provide your personal and financial information as requested by the app. This might include details like your employment status, income source, and bank account details.

- Choose Loan Option: Select the desired loan amount and repayment tenure that aligns with your needs. Carefully review the interest rate and any associated fees before proceeding.

- Review and Accept: Thoroughly review the loan agreement and terms and conditions before electronically signing the agreement.

- Loan Disbursement: Upon loan approval, the loan amount will be credited directly into your bank account within a timeframe specified by the app (usually within 24-48 hours for most apps).

Eligibility Requirements and Documents Required: Who Qualifies?

Here’s a general overview of the eligibility criteria and documents typically required by Best RBI Approved Loan Apps in India:

- Indian Citizenship: You must be a citizen of India to be eligible for a loan.

- Age: The minimum age requirement typically falls between 21 and 23 years old, and the upper limit might be around 55-60 years old (it can vary slightly by app).

- Source of Income: You’ll need to demonstrate a stable source of income, such as salary slips for salaried individuals or bank statements for self-employed professionals.

- Aadhaar Card: This serves as primary identification proof.

- PAN Card: Essential for tax purposes.

- Good CIBIL Score: A healthy credit score increases your chances of approval and can lead to better interest rates.

Additional documents might be required depending on the app, loan amount, and your employment status. Here are some examples:

- Salaried Individuals: Salary slips for the past few months, employment verification letter.

- Self-Employed Individuals: Bank statements reflecting income flow, Income Tax Returns (ITRs) for the past few years.

- Students: Proof of enrollment in a recognized educational institution, scholarship or stipend letters (if applicable).

Remember: Eligibility criteria and document requirements can vary slightly between apps. Always refer to the specific app’s website or in-app information for the most accurate details.

Responsible Borrowing Practices: A Guide to Financial Wellness

Even with the convenience of Best RBI Approved Loan Apps in India, borrowing money comes with responsibility. Here are some essential tips for responsible borrowing:

- Borrow Only What You Need: Avoid unnecessary borrowing and only take out a loan you can comfortably repay within the stipulated timeframe. Don’t get tempted to over-borrow based on the ease of access.

- Understand Interest Rates and Fees: Be clear about the total loan cost, including the Annual Percentage Rate (APR) and any additional processing fees or prepayment penalties. Don’t get caught off guard by hidden charges.

- Choose the Right Repayment Tenure: Select a repayment plan that aligns with your budget without straining your finances. Consider factors like your income and existing financial obligations when choosing a repayment tenure.

- Make Timely Payments: Late payments can damage your credit score and attract penalties. Set up reminders or automate your loan repayments to ensure you stay on track.

- Explore Alternatives: Before opting for a loan app, consider alternative options like credit cards, personal loans from traditional banks, or dipping into your savings (if possible). Evaluate all options and choose the one that best suits your needs and financial situation.

Conclusion: Making Informed Decisions with the Best RBI Approved Loan Apps in India

Best RBI Approved Loan Apps in India offer a fast, convenient, and secure solution for your financial needs. By understanding the benefits, popular options, application processes, and responsible borrowing practices, you can leverage these apps for your financial well-being. Here are some key takeaways:

- Prioritize Security: Always choose Best RBI Approved Loan Apps in India to ensure data security, fair lending practices, and consumer protection mechanisms.

- Compare and Choose: Research and compare different Best RBI Approved Loan Apps in India based on factors like interest rates, loan amounts, eligibility criteria, and features before making a decision.

- Borrow Responsibly: Only borrow what you need, understand all loan terms, and commit to timely repayments to maintain a healthy credit score and financial standing.

With informed decision-making and responsible borrowing practices, Best RBI Approved Loan Apps in India can be a valuable tool in your financial journey. Remember, use these apps wisely and prioritize your financial well-being.

Best RBI Approved Loan Apps in India list 2024

| S. No. | App Name | Credit Limit |

|---|---|---|

| 1 | Kreditbee Instant Loan App | Loan up to ₹2 Lakh |

| 2 | Kreditzy Instant Loan App | Loan up to ₹2 Lakh |

| 3 | Paysense | Loan up to 5 Lakhs |

| 4 | NAVI | Loan up to 5 Lakhs |

| 5 | Lazypay (Credit Line + Personal Loan) | Loan up to 1 Lakhs |

| 6 | Freopay | Loan up to ₹10000 |

| 7 | Stashfin | Loan up to 5 Lakh |

| 8 | Cashbean– Online Loan App | Loan up to 1 Lakhs |

| 9 | MI Credit | Above 5 Lakhs |

| 10 | Dhani Loan App | Loan up to 5 Lakh |

| 11 | Avail Finance | Loan up to ₹50000 |

| 12 | NIRA Instant Loan App | Loan up to 2 Lakh |

| 13 | Branch Loan App | Loan up to ₹50,000 |

| 14 | Smart coin Loan App | Loan up to 2 Lakhs |

| 15 | Rupeek App (Gold Loan) | Loan up to 50 Lakhs |

| 16 | Simple Pay Later | Loan up to 1 Lakhs |

| 17 | Mobikwik (Credit Line + Consumer Loan) | Loan up to 2 Lakh |

| 18 | Paytm Personal Loan | Loan up to 2 Lakh |

| 19 | Krazybee (Consumer Loan) | Loan up to 2 Lakh |

| 20 | Bharatpe (Business Loan) | Loan up to 5 Lakh |

| 21 | Paytm Postpaid (Credit Line) | Loan up to 1 Lakhs |

| 22 | True Caller | Loan up to 5 Lakh |

| 23 | Simply Cash Loan App | Loan up to 2 Lakh |

| 24 | Slice | Loan up to 1 Lakhs |

| 25 | True Balance | Loan up to ₹50,000 |

| 26 | Zest M28oney (Consumer Loan) | Above 2 Lakh |

| 27 | Amazon Pay Later | Loan up to ₹60,000 |

| 28 | Flipkart Pay Later | Loan up to ₹60,000 |

| 29 | Tata Capital | Above 10 Lakhs |

| 30 | Tata neu Credit card (Qik EMI Card) | ₹10000 to ₹150000 |

| 31 | Tata Neu App (Qik Personal Loan) | ₹10000 to ₹10,00,000 |

| 32 | Ola Money pay Later | ₹1500 to ₹20000 |

| 33 | Khatabook Instant Loan App | ₹50,000 to ₹0,00,000 |

| 34 | Jupiter credit limit | Loan up to ₹50,000 |

| 35 | OneCard Loan App | ₹10000 to ₹150,000 |

| 36 | Paisabazaar credit limit | ₹50,000 to ₹10,00,000 |

| 37 | imobile Pay Later | Loan up to ₹ 20,000 |

| 38 | SBI YONO APP | ₹1500 to ₹60000 |

| 39 | India IDFC First Bank Pay later | ₹1500 to ₹ 60000 |

| 40 | Bajaj Finserv App | ₹ 50,000 to ₹ 5,00,000 |

| 41 | Rufilo Loan App | ₹5000 to ₹25,000 |

| 42 | IBL FINANCE App | ₹5000 to ₹25,000 |

| 43 | Early Salary Instant Loan App | ₹ 8,000 to ₹ 500,000 |

| 44 | Money View | ₹10,000 to ₹ 5,00,000 |

| 45 | CASHe | ₹1,000 to ₹ 3,00,000 |

| 46 | mPokket | ₹500 to ₹30,000 |

| 47 | Stashfin – Credit Line & Loan | ₹1,000 to ₹5,00,000 |

| 48 | MoneyTap | ₹1,000 to₹60,000 |

| 49 | FairMoney Loan App | Loan up to 2 Lakh |

| 50 | KreditOne | ₹5000 to ₹25,000 |

| 51 | FlexSalary Instant Loan App | ₹5000 to ₹25,000 |

| 52 | DigiMoney– Online Loan App | ₹5000 to ₹25,000 |

| 53 | Indialends | Loan up to ₹5,00,000 |

| 54 | Mystro Loans & Neo Banking app | Loan up to ₹50,000 |

| 55 | Kissht: Instant Line of Credit | ₹10,000 to ₹ 1,00,000 |

| 56 | IndusMobile: Digital Banking | ₹5000 to 200,000 |

| 57 | Prefr: Get instant loan | ₹10,000 to ₹3,00,000 |

| 58 | InstaMoney Personal Loan | ₹5,000 to ₹25,000 |

| 59 | Swift Loan– Online Loan App | Loan up to ₹50,000 |

| 60 | RapidPaisa | ₹ 1,000 – ₹ 10,000 |

| 61 | CreditScore, CreditCard, Loans | Loan up to ₹ 5 Lakh |

| 62 | Bajaj MARKETS: Loan, Card, UPI | Loan up to ₹25 Lakhs |

| 63 | Fullerton India Credit Company Limited | Loan up to ₹25 lakhs |

| 64 | LoanFront | ₹2000 to ₹2 lakhs |

| 65 | Pocketly | Loan up to ₹10,000 |

| 66 | Bueno Loans | Loan up to ₹25000 |

| 67 | PayRupik– Online Loan App | Loan up to ₹20,000 |

| 68 | Loaney | ₹200 to ₹20,000 |

| 69 | RupeePark | ₹5,000 to ₹500,000 |

| 70 | Cash Planet – Online Loan App | ₹5,000 to ₹500,000 |

| 71 | CreditScore – PaisaBazaar | ₹ 1000 to ₹ 50,000 |

| 72 | Money Tap | ₹ 3000 to ₹ 5 lakh |

Welcome to Investopedia.co.in, your trusted source for insightful content on Finance, Business, Stock Market, and trending topics. Founded by Vivek Ranva, a seasoned professional with a master's degree in finance and taxation, we are dedicated to delivering educational and engaging articles that empower your learning journey.