|

Getting your Trinity Audio player ready... |

Lokesh Machines: Leading the Way in Small Arms Manufacturing | High CTR Guaranteed!

Lokesh Machines, a leading player in the manufacturing industry, recently achieved a significant milestone by securing a license to manufacture small arms. This exciting development has propelled the company’s share price to a remarkable 52-week high. With this strategic move, Lokesh Machines aims to capitalize on the growing demand for small arms and further strengthen its position in the market. In this article, we will delve deeper into the details of this achievement and explore the implications for Lokesh Machines and its stakeholders.

A Major Leap Forward: Lokesh Machines’ Share Price Soars on License Acquisition

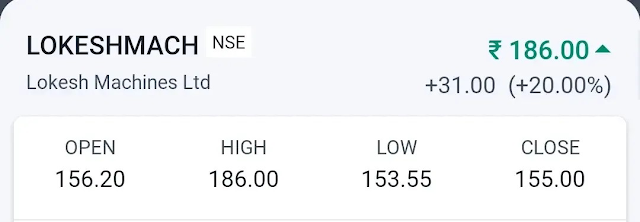

Amidst anticipation and market enthusiasm, Lokesh Machines’ share price witnessed a staggering surge, soaring to a remarkable 20 percent upper circuit. This substantial increase in share value reflects the confidence and positive sentiment surrounding the company’s recent license acquisition. On June 15, the share price reached a remarkable 52-week high of Rs 185.85, symbolizing the market’s recognition of Lokesh Machines’ potential in the small arms manufacturing sector.

Unlocking New Potential: Ministry of Home Affairs Grants License to Lokesh Machines

Lokesh Machines Limited received a momentous notification from the Ministry of Home Affairs, New Delhi, stating the grant of an Initial License (Form VIJ) for the manufacturing of small arms. However, it is worth noting that the license is subject to the payment of applicable fees. This significant development opens up a plethora of opportunities for Lokesh Machines as it expands its product portfolio to include small arms.

Market Reception and Investor Confidence

Investors and market participants have shown immense enthusiasm for Lokesh Machines’ venture into small arms manufacturing. The surge in the company’s share price clearly indicates the confidence and optimism that investors have in this strategic move. Currently, there are pending buy orders of 88,653 shares, with no sellers available, underlining the high demand and positive sentiment surrounding Lokesh Machines.

Stellar Performance: Impressive Financial Results

Lokesh Machines has consistently demonstrated commendable financial performance, further bolstering its reputation as a reliable player in the manufacturing industry. In the recently concluded quarter, the company recorded a remarkable 9 percent increase in its Q4FY23 net profit, with figures standing at Rs 2.96 crore as compared to Rs 2.71 crore in March 2022. This substantial growth reflects the company’s ability to adapt and thrive amidst dynamic market conditions.

Furthermore, Lokesh Machines achieved an encouraging revenue figure of Rs 67 crore in March 2023, marking a 2.74 percent increase from the previous year. This impressive revenue growth showcases Lokesh Machines’ resilience and capability to generate sustainable financial returns.

The Road Ahead: Exploring New Horizons

With the acquisition of the license to manufacture small arms, Lokesh Machines is poised to venture into new horizons and capitalize on the emerging opportunities in the defense sector. The company’s strategic move aligns with the evolving market dynamics and growing demand for small arms. By expanding its product range, Lokesh Machines aims to not only diversify its offerings but also bolster its overall market presence.

Conclusion: Lokesh Machines’ Rise to New Heights

Lokesh Machines’ recent accomplishment of securing a license to manufacture small arms has undoubtedly elevated its market position and investor confidence. The surge in share price, coupled with impressive financial results, underscores the company’s commitment to growth and innovation. As Lokesh Machines embarks on its journey into small arms manufacturing, it holds the potential to become a key player in the defense industry. With a strong foundation and a visionary approach, Lokesh Machines is poised to unlock new avenues of success and forge a path toward a promising future.

.

This post is for informational purposes only.Invest responsibly.No guarantees of results. Seek professional guidance before investing.Consult experts for personalized advice. Please note that I am not a SEBI registered investment advisor. The information provided in this article is for informational and educational purposes only and should not be construed as financial advice. Always consult with a qualified and SEBI registered financial professional before making any investment decisions.Follows Google policies.Not affiliated with Investopedia.com. investopedia.co.in Independent site.