|

Getting your Trinity Audio player ready... |

Master the stock market with Finviz Stock Screener, the FREE powerful stock screener. Find winning investments using in-depth filters, charts, and analysis tools. Beginner-friendly guide included!

Want to conquer the stock market but overwhelmed by jargon? Finviz Stock Screener is your FREE solution! This comprehensive guide unlocks the power of Finviz’s screener and analysis tools to empower your investment decisions, regardless of your experience level. Learn how to find winning stocks and build a successful investment strategy with Finviz today!

Unleash Your Inner Stock Market Guru: A Comprehensive Guide to Finviz Stock Screener

Conquering the stock market can feel like navigating a treacherous jungle. Information overload, confusing jargon, and endless charts can leave even seasoned investors feeling lost. But fear not, intrepid explorer! Finviz, a powerful stock screener, is here to be your machete, compass, and treasure map rolled into one.

This comprehensive guide will equip you with the knowledge to unlock the full potential of Finviz and transform your investment strategies. Whether you’re a chart-wielding technical analyst or a value-driven fundamentalist, Finviz has the tools to empower your decisions.

Also Read : Dow surpasses Q1 earnings projections along with global production development

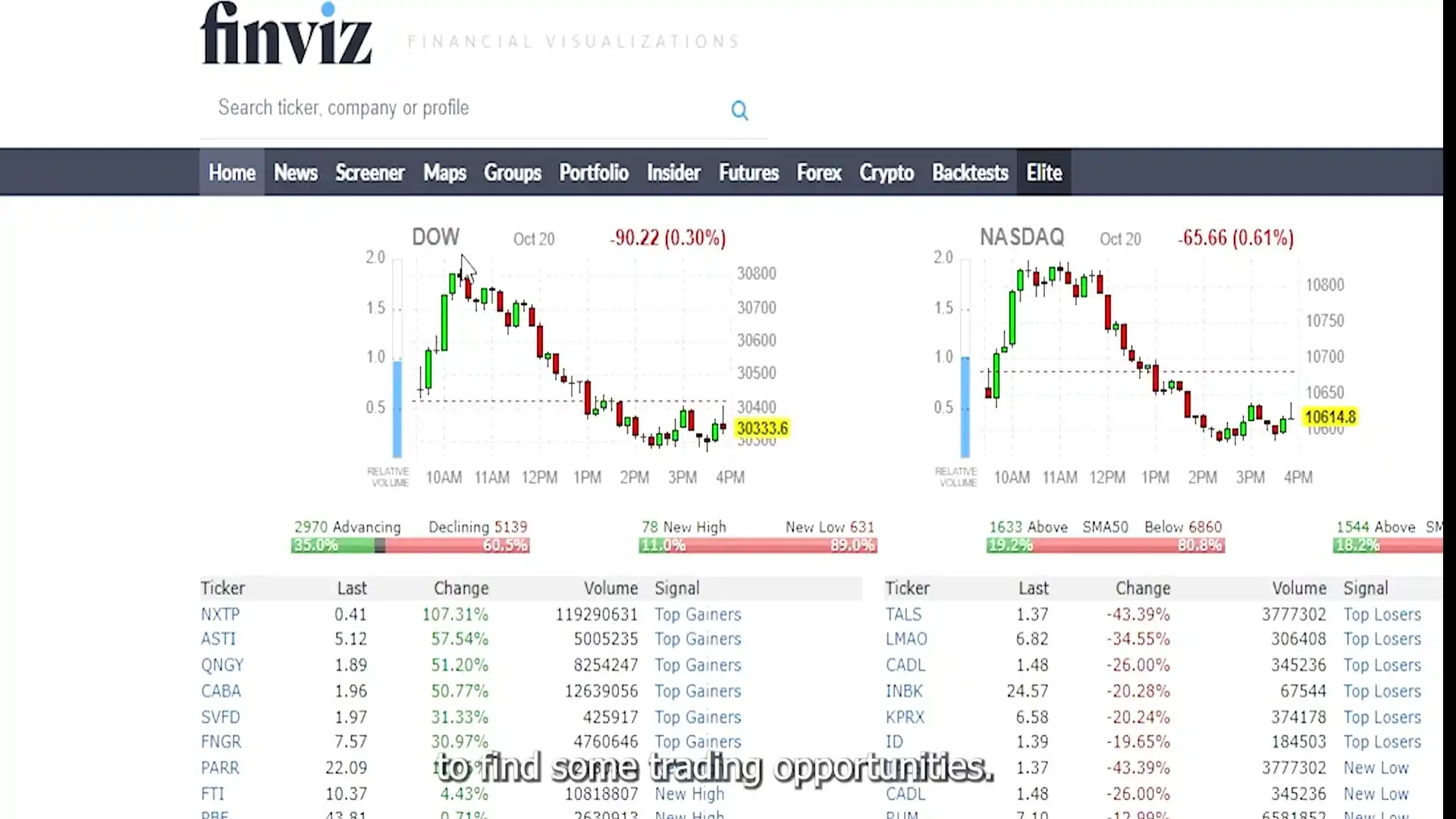

Understanding Finviz Stock: Your Gateway to Investment Insights

Finviz, short for Financial Visualization, is a free online platform offering a treasure trove of financial analysis tools. Its crown jewel is the legendary stock screener, a sophisticated filter system designed to pinpoint stocks that align with your investment goals.

Think of it as a personalized casting call for the stock market. You set the criteria (the role), and Finviz scours the market, presenting you with a shortlist of potential all-stars.

Demystifying the Screener: Your Stock-Picking Powerhouse

The Finviz screener boasts three main categories, each a powerful weapon in your investment arsenal:

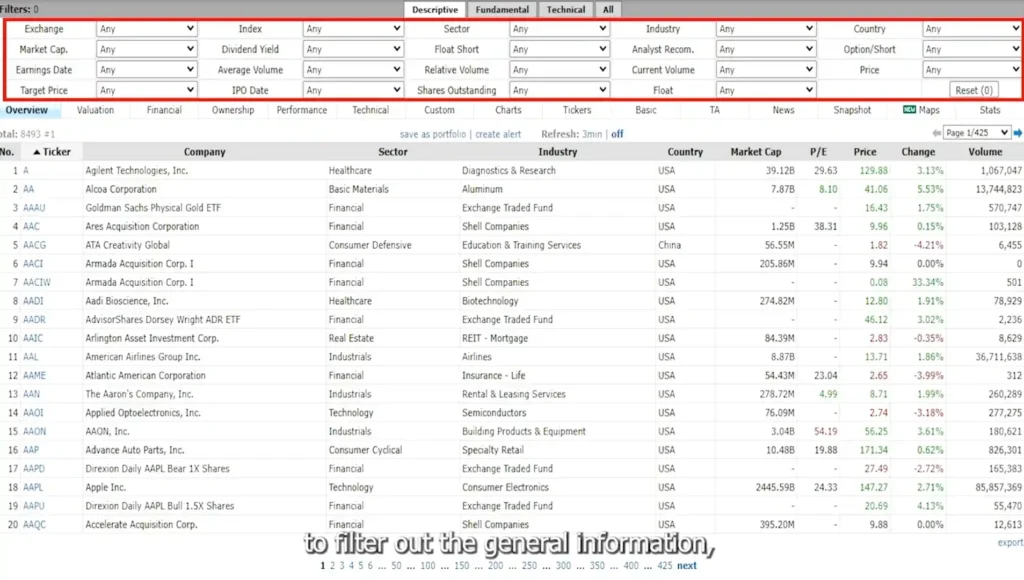

Descriptive Criteria:

These are your basic filters, akin to the initial casting call. You can specify market capitalization (large-cap, mid-cap, or small-cap), price range, average trading volume, and even industry sector to narrow down the search.

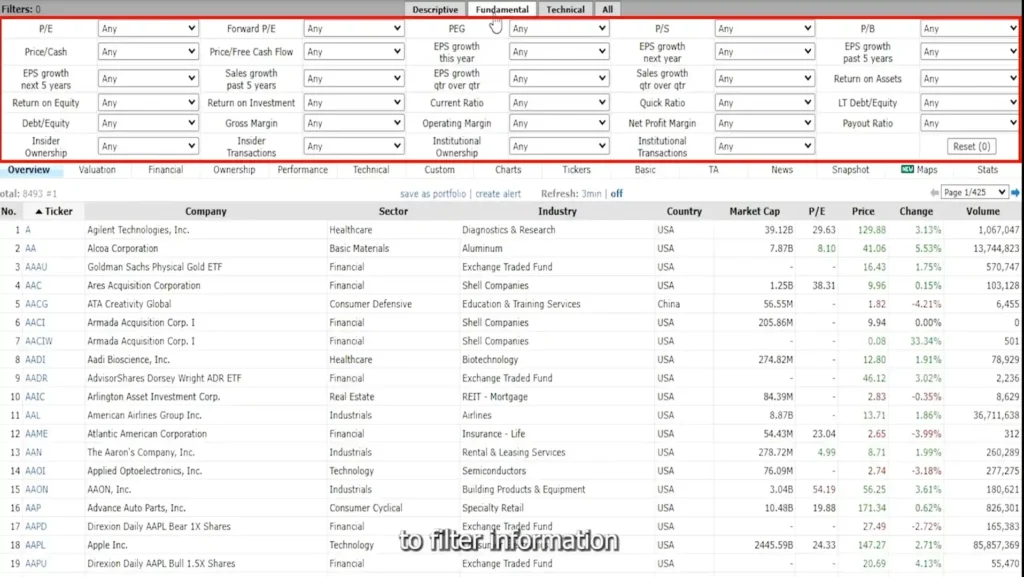

Fundamental Criteria:

Here’s where you delve deeper, analyzing a company’s financial health. Metrics like price-to-earnings (P/E) ratio, gross margin, and debt-to-equity ratio provide valuable insights into a company’s profitability, efficiency, and financial stability.

Technical Criteria:

For the chart lovers, this section offers a playground of technical indicators like moving averages, Relative Strength Index (RSI), and MACD. These tools can help identify potential entry and exit points for trades based on historical price trends and market sentiment.

Beyond the Basics: Unveiling Finviz’s Hidden Gems

While the free version of Finviz offers a robust set of features, the Elite subscription unlocks even more powerful tools:

- Real-time Data: Make informed decisions based on up-to-the-minute market movements.

- Backtesting Options: Test your investment strategies on historical data to refine your approach.

- Advanced Screener Features: Create even more intricate filters to target highly specific investment opportunities.

Putting Finviz to Work: A Step-by-Step Guide to Investment Success

- Define Your Criteria: Before diving in, determine your investment goals and risk tolerance. Are you seeking high-growth stocks or dividend-paying stalwarts? Tailor your screener filters accordingly.

- Technical Analysis: Leverage Finviz’s charting tools or integrate them with platforms like TradingView to confirm your trade ideas and identify potential entry and exit points.

- Conduct Due Diligence: Don’t rely solely on Finviz. Research the companies on your shortlist, analyze their fundamentals, and understand their business model.

- Execute Your Trade: With your analysis complete, make your move based on your predetermined risk tolerance and investment strategy. Remember, even the best tools can’t guarantee success – invest wisely!

Case Studies: Unveiling the Power of Finviz Stock

Let’s see Finviz in action! Imagine you’re a value investor seeking high-dividend stocks with a strong track record. You can set filters for companies with a P/E ratio below 15, a dividend yield exceeding 5%, and a history of consistent dividend growth. Finviz would then present you with a shortlist of potential dividend powerhouses, allowing you to focus your research efforts.

Beyond Ranking: Building a Sustainable Investment Strategy

While achieving a top Google ranking is a worthy goal, remember that true success lies in building a sustainable investment strategy. Finviz is a powerful tool, but it’s just one piece of the puzzle. Always conduct thorough due diligence, understand market risks, and diversify your portfolio to mitigate losses.

Conclusion: Finviz – Your Stock Market Ally

With its user-friendly interface, powerful screening capabilities, and wide range of analysis tools, Finviz Stock empowers you to make informed investment decisions and navigate the often-turbulent waters of the stock market. So, grab your metaphorical machete, set sail with Finviz as your compass, and embark on your journey to becoming a stock market guru!