|

Getting your Trinity Audio player ready... |

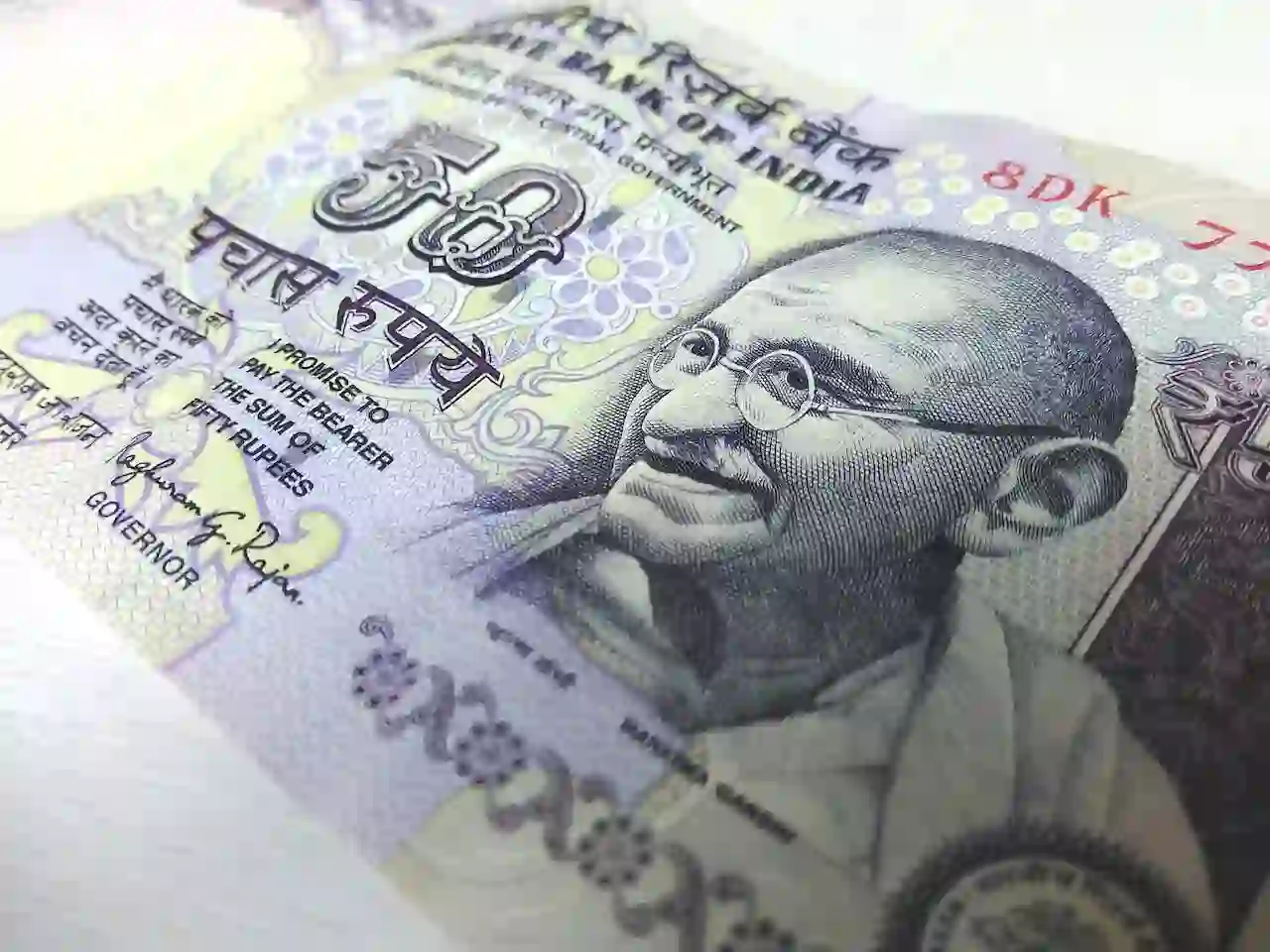

In the ever-evolving tapestry of global currencies, the Indian rupee recently etched a new chapter, closing at a record low of 83.38 against the formidable US dollar. This precarious descent, though nuanced, reverberated across financial landscapes, prompting discerning observers to unravel the intricacies of the forex market dance.

Factors in the Spotlight Indian Rupee

1. Dollar Demand from Oil Companies:

The heartbeat of this narrative lies in the heightened demand for dollars from oil companies. This surge, akin to a tempest, collided with interventions orchestrated by the Reserve Bank of India (RBI), sculpting the contours of the day’s forex market dynamics.

2. RBI Intervention :

The RBI, the vigilant guardian of India’s monetary stability, wove interventions into the fabric of the day. Despite its best efforts, the rupee‘s descent, while restrained, signaled the challenges faced by the central bank in navigating the forex market’s labyrinth.

Regional Currency Trends: A Synchronized Symphony of Depreciation

1. Weakening Asian Currencies:

The rupee’s descent found kinship across Asia as a multitude of currencies, including the South Korean won, Taiwanese dollar, and Thai baht, succumbed to depreciation. This collective descent hinted at broader economic challenges echoing through the region.

2. Range-Bound Performance:

Within the confines of a week, the Indian rupee orchestrated a dance, fluctuating between 83.22 and 83.38. Despite the ebb and flow induced by importers’ buying, RBI’s dollar selling, and the ripples of initial public offerings (IPOs), the trajectory remained stubbornly range-bound.

Rupee’s Yearly Performance: A Tale of Resilience and Foreign Reserves

1. Resilience Amidst Global Challenges:

The year 2023 witnessed the Indian rupee donning the cloak of resilience, with a mere 0.8% depreciation. A stark departure from its 2022 narrative, where the rupee bore the brunt of global upheavals, experiencing a depreciation exceeding 10%.

2. Central Bank Action and Foreign Reserves:

Central to this narrative is the symphony orchestrated by the RBI in the foreign exchange market. Amidst the cacophony of volatility, the significance of India’s foreign exchange reserves took center stage. A robust reserve kitty of $596 billion, spanning 10 months of imports, fortified by an infusion of $34 billion in 2023, underscored India’s commitment to stability in the forex market.

Unveiling the Puzzle: Questions Related to Exams

Q1: Why did the Indian rupee close at a new low of 83.38 against the US dollar?

A1: The rupee’s descent was a complex interplay of heightened dollar demand from oil companies and meticulous interventions by the Reserve Bank of India (RBI), acting as a bulwark against a steeper fall.

Q2: What factors contributed to the weakening of most Asian currencies, including the South Korean won and Taiwanese dollar?

A2: Beyond the confines of the Indian subcontinent, the broader weakening of Asian currencies found roots in regional economic challenges and the intricate tapestry of the global economic landscape.

Q3: How did the Indian rupee perform in 2023 compared to the previous year, and what were the key factors influencing its resilience?

A3: 2023 showcased the Indian rupee’s resilience, depreciating a mere 0.8% compared to the tumultuous 10% of 2022. The factors weaving this resilience included the vigilant interventions by the RBI and the robust foreign exchange reserves that shielded the currency from global storms.

This post is for informational purposes only.Invest responsibly.No guarantees of results. Seek professional guidance before investing.Consult experts for personalized advice. Please note that I am not a SEBI registered investment advisor. The information provided in this article is for informational and educational purposes only and should not be construed as financial advice. Always consult with a qualified and SEBI registered financial professional before making any investment decisions.Follows Google policies.Not affiliated with Investopedia.com. investopedia.co.in Independent site.