|

Getting your Trinity Audio player ready... |

Get instant relief with a i need 3000 rupees loan urgently. No hassle, no wait. Apply now and seize financial freedom!

Your Definitive Guide to Securing an i need 3000 rupees loan urgently

Are you facing a sudden financial shortfall and finding yourself in need of immediate assistance? i need 3000 rupees loan urgently Don’t worry; you’re not alone. Many individuals encounter unexpected expenses or emergencies that require quick access to funds.

In such situations, a small loan of Rs. 3000 can provide the necessary financial support to tide you over until your next paycheck. This comprehensive guide will walk you through everything you need to know about obtaining an urgent Rs. 3000 loan, including eligibility criteria, documentation requirements, application process, and more.

Understanding the Urgency: Why i need 3000 rupees loan urgently

Life can throw unexpected curveballs at us when we least expect them, leaving us in dire need of immediate financial assistance. Here are some common scenarios where i need 3000 rupees loan urgently:

- Medical Emergencies: Whether it’s unexpected medical bills or the need for urgent medication, healthcare expenses can arise suddenly and require immediate attention.

- Vehicle Repairs: Car or bike breakdowns can happen unexpectedly, and getting them fixed promptly is essential for your daily commute.

- Utility Bills: Sometimes, unforeseen circumstances may lead to higher-than-expected utility bills, putting a strain on your finances.

- Travel Expenses: Urgent travel needs may arise due to family emergencies or unforeseen circumstances, necessitating quick access to funds.

Benefits of an Urgent Rs. 3000 Loan

Taking out a small loan of i need 3000 rupees loan urgently can offer several benefits, including:

- Immediate Financial Relief: A loan of this amount can provide immediate relief in urgent situations, helping you cover essential expenses without delay.

- Minimal Documentation: Small loans typically require minimal documentation, making the application process quick and hassle-free.

- Flexible Repayment Options: You can choose a repayment plan that suits your financial situation, ensuring manageable payments.

- Improvement of Credit Score: Timely repayment of the loan can positively impact your credit score, strengthening your financial profile for future borrowing needs.

- Accessibility: Small loans are often accessible to individuals with varying credit histories, making them an inclusive financial option for those in need.

Eligibility Criteria for an Urgent Rs. 3000 Loan

Before applying for i need 3000 rupees loan urgently, it’s essential to understand the eligibility criteria set by lenders. Here are the common requirements:

- Age: You must be at least 18 years old to apply for a loan.

- Residency: You need to be a resident of India to qualify for most loans.

- Identification: Valid ID proof such as Aadhaar, PAN card, or passport is required.

- Bank Account: You must have an active bank account for loan disbursal and repayment.

Also read : Unveiled: 9 types of Private Equity Strategies for Savvy Investors

Documents Required for an Urgent Rs. 3000 Loan

When applying for a Rs. 3000 loan, you’ll need to provide the following documents:

- ID Proof: Aadhaar, PAN card, or passport.

- Address Proof: Utility bill or rental agreement.

- Bank Statement: Last three months’ bank statements.

- Salary Slips: If employed, provide salary slips for the past three months.

Having these documents ready will streamline the loan application process and expedite approval.

How to Apply for an Instant Loan for Rs. 3000

Follow these steps to apply for an instant Rs. 3000 loan:

- Research Lenders: Explore reputable lenders offering small loans and compare their terms and interest rates.

- Check Eligibility: Review the eligibility criteria of each lender to ensure you meet the requirements.

- Gather Documents: Collect all the required documents, including ID proof, address proof, bank statements, and salary slips.

- Apply Online: Many lenders offer online application options for convenience. Fill out the application form and upload your documents.

- Wait for Approval: After submitting your application, wait for the lender to review and process it. Approval times may vary.

- Receive Funds: Upon approval, the loan amount will be disbursed directly to your bank account.

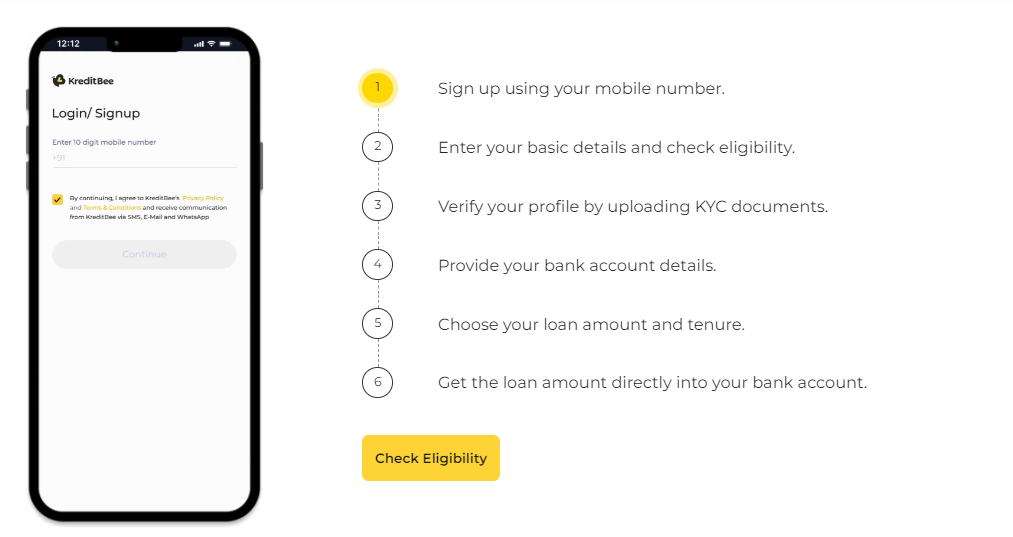

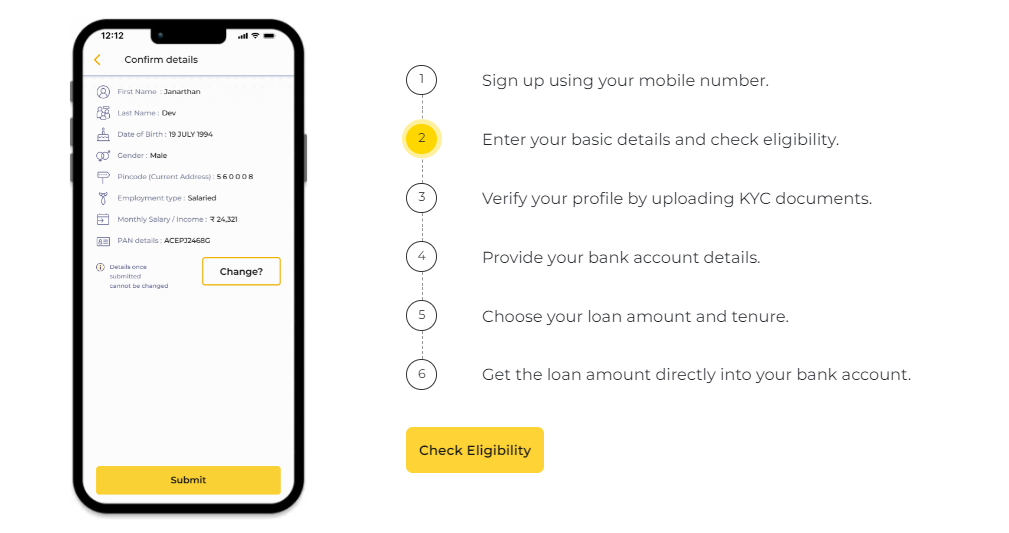

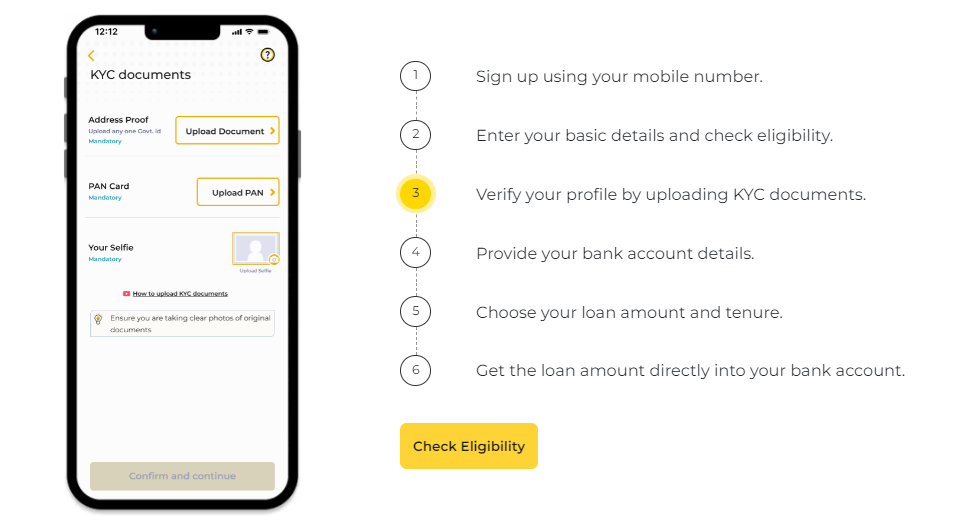

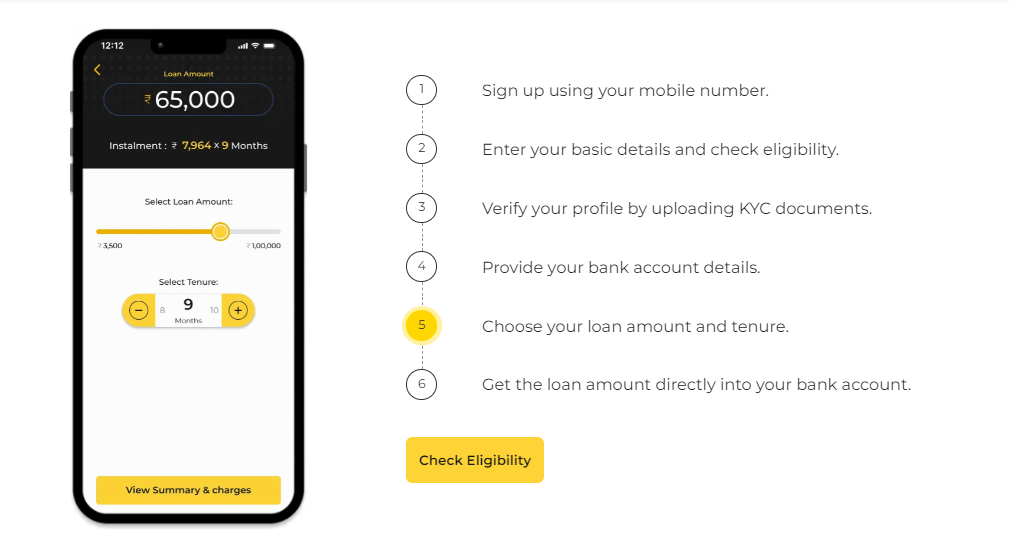

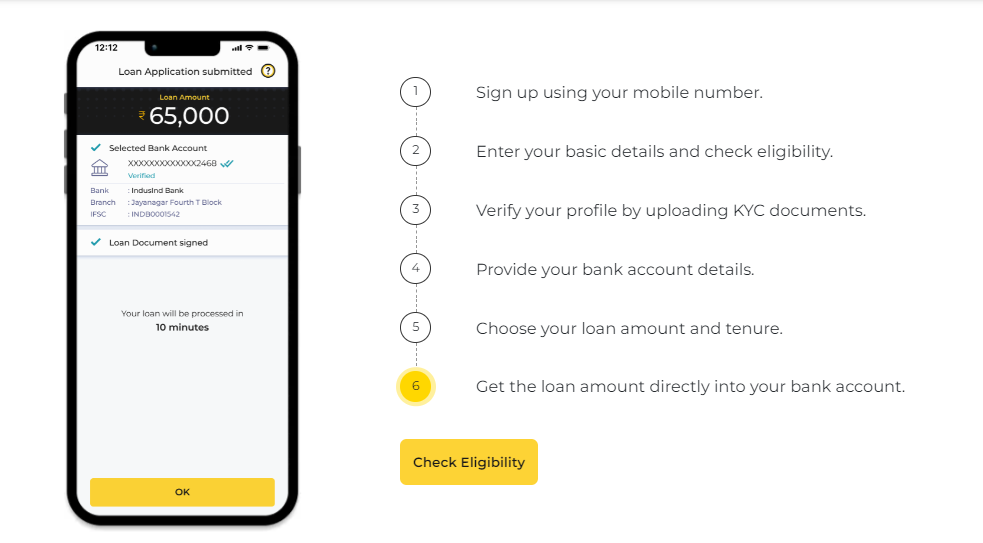

i need 3000 rupees loan urgently follow this below Step using kreditbee

(kreditbee for Example ,educational Purpose only not paid promotion,this site not suport this apps or web)

Real-Life Example: How Anjali Overcame a Financial Emergency with a Rs. 3000 Loan

Anjali, a college student, found herself in a tight spot when her laptop suddenly stopped working during exam week. Desperate to replace it before her exams, she realized that she i need 3000 rupees loan urgently to afford a new one. With minimal savings and no credit history, she was unsure where to turn. After researching online, she discovered a reputable lender offering small loans with easy eligibility criteria.

Anjali quickly gathered the necessary documents, filled out the online application form, and received approval within hours. The next day, she received the loan amount in her bank account and was able to purchase a new laptop in time for her exams. Thanks to the timely assistance of the Rs. 3000 loan, Anjali was able to overcome her financial emergency and achieve academic success.

Also Read : Unlocking the Secrets of Private Equity Strategies: Expert Insights Await!

Conclusion: Empowering You with Financial Solutions

In times of financial urgency, a small loan of Rs. 3000 can provide the immediate relief needed to overcome unexpected expenses and emergencies. By understanding the eligibility criteria, documentation requirements, and application process outlined in this guide, you can navigate the loan application process with confidence and ease.

Remember to compare lenders, review terms carefully, and prioritize timely repayment to make the most of your borrowing experience. With responsible financial management and informed decision-making, you can leverage small loans to address your immediate financial needs and achieve peace of mind. i need 3000 rupees loan urgently So, take the first step towards securing your urgent Rs. 3000 loan today and gain the financial freedom you deserve.