|

Getting your Trinity Audio player ready... |

Voltas Share Price Today (30 Oct 2024): Live Updates and Analysis

Opening Summary

Stay updated on Voltas share price for 30 October 2024 as it continues to trend in the Indian stock market. With fluctuations in key levels and a focus on recent earnings, Voltas is capturing investor attention today. Here, we track live intraday changes, analyze support and resistance levels, and offer insights on broader market trends affecting Voltas’ performance.

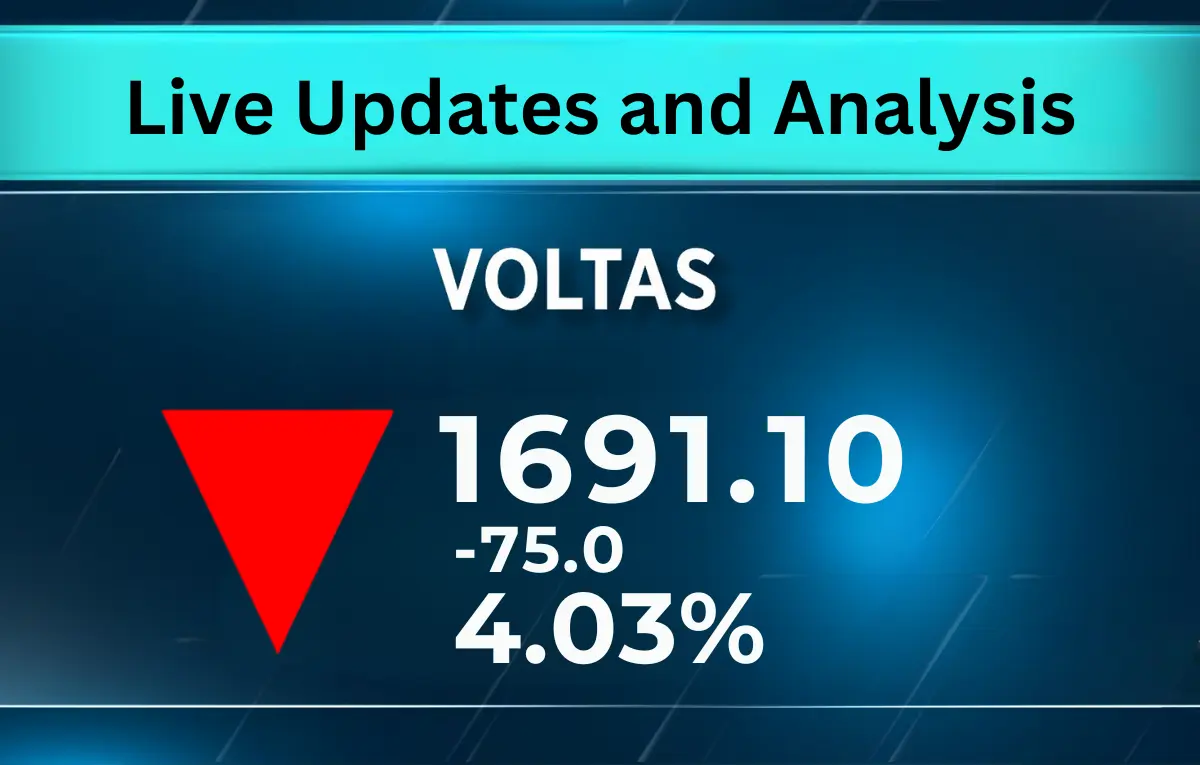

Live Updates: Voltas Stock Price Movement for 30 Oct 2024

Track real-time price updates as the market unfolds.

- Current Price: Rs 1,671.4 (-5.60% from yesterday)

- Intraday High: Rs 1,775.2

- Intraday Low: Rs 1,724

- 52-Week High/Low: Rs 1,946.2 / Rs 811.5

- Trading Volume (BSE/NSE): 24,967 shares / 1,524,171 shares

Keep this page refreshed for live price updates and stay ahead of Voltas’ market movements.

Key Support and Resistance Levels for Voltas (30 Oct 2024)

Analyzing support and resistance levels provides insights into possible price movement throughout the day. For Voltas, these levels may signal buy/sell opportunities for traders and investors:

- Daily Pivot Level: Rs 1,716.23

- Resistance Levels:

- R1: Rs 1,775.72

- R2: Rs 1,864.38

- R3: Rs 1,923.87

- Support Levels:

- S1: Rs 1,627.57

- S2: Rs 1,568.08

- S3: Rs 1,479.42

These support and resistance zones can act as potential buy or sell points as trading intensifies. Keep an eye on any breakouts or rebounds from these levels as indicators of possible intraday trends.

Voltas Stock Moving Averages and Market Trends

Moving averages offer a longer-term view of Voltas’ stock behavior across various periods. Here’s how recent trends compare:

- 5-Day SMA: Rs 1,820.09 | 5-Day EMA: Rs 1,776.25

- 20-Day SMA: Rs 1,824.82 | 20-Day EMA: Rs 1,803.64

- 50-Day SMA: Rs 1,795.67 | 100-Day SMA: Rs 1,636.62

- 200-Day SMA: Rs 1,405.88

Traders often watch these averages to assess potential entry and exit points. A higher short-term SMA suggests current upward momentum, whereas a wider gap between the 100-day and 200-day averages reflects a sustained trend.

Voltas vs. Sector Peers: Comparative Performance Over the Past Year

Voltas shares have registered a remarkable 100.3% increase over the past year. Here’s a quick look at how Voltas fares against major competitors in the BSE Consumer Durables sector:

- Voltas: Up from Rs 834.4 to Rs 1,671.4 (+100.3%)

- Dixon Technologies: +191.1%

- Blue Star: +112.9%

- Amber Enterprises: +108.3%

These gains reflect positive investor sentiment across the consumer durables industry, particularly as companies report strong earnings and revenue growth.

Voltas Financial Summary: Q2 Earnings and Annual Performance

Voltas posted impressive financial results for the quarter ended September 2024, underscoring strong growth across key performance indicators:

- Q2 Net Profit: Rs 1,651 million (+139.9% YoY)

- Q2 Net Sales: Rs 26,191 million (+14.2% YoY)

- FY24 Net Profit: Rs 2,481 million (+82.1% YoY)

- FY24 Revenue: Rs 124,812 million (+31.4% YoY)

The Price-to-Earnings (P/E) Ratio stands at 80.5, suggesting a high valuation reflecting investor confidence but also the need for sustained growth to justify the premium.

Sector and Economic Factors Influencing Voltas’ Performance

Economic indicators such as inflation, interest rates, and consumer spending trends are key factors impacting Voltas and the broader Indian consumer durables sector. Recent shifts in government policy, particularly on infrastructure and urbanization, have bolstered the demand for consumer durables, placing Voltas in a strong position for continued growth.

Expert Analysis and Investor Sentiment on Voltas Stock

Leading analysts have weighed in on Voltas with mixed insights. Here’s what top brokerage firms have shared:

- Buy Rating: Many firms highlight Voltas’ robust revenue growth and market share expansion, particularly in air conditioning and cooling solutions.

- Hold Rating: Caution around high valuations, with some analysts urging a wait-and-watch approach for potential price corrections.

- Sell Rating: Limited, but a few concerns about competition in the consumer durables space are noted.

Investors looking for entry opportunities may consider monitoring price corrections, while long-term holders are encouraged to watch for quarterly updates and growth strategies.

Investor Poll: What’s Your Prediction for Voltas?

Have an opinion on Voltas’ stock movement? Participate in our quick poll:

- Bullish – Expect Voltas to rise by end of Q4 2024

- Bearish – Anticipate a price correction or sideways movement

- Neutral – Holding steady for long-term gains

Conclusion

Today’s live Voltas share price updates offer a detailed look at intraday changes, key technical levels, and insights from the latest earnings report. With a strong foothold in the consumer durables sector and consistent performance, Voltas remains a prominent choice for investors, despite broader market volatility.

Stay tuned for continued updates, sector analysis, and expert commentary as we track Voltas’ journey in the Indian stock market.