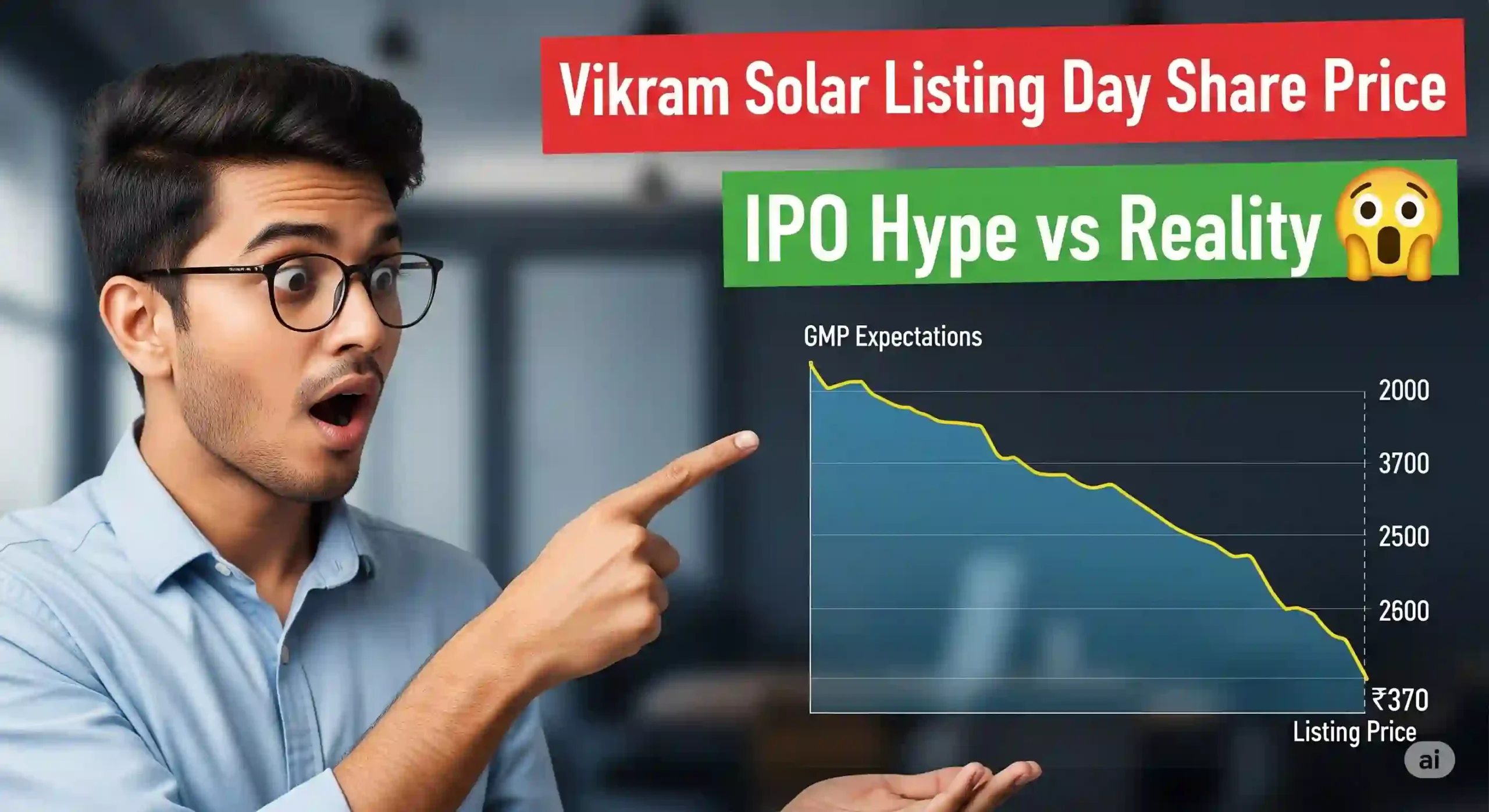

The much-awaited Vikram Solar share price today made its debut on the Indian stock market, but the outcome surprised many investors. Despite the IPO being oversubscribed 56.42x, the stock opened with only a marginal premium. On the BSE, it listed at ₹340 (2.4% up), while on the NSE, it opened at ₹338 (1.8% up).

This was a big contrast to the Grey Market Premium (GMP), which had hinted at a stronger 15–20% listing gain. The muted debut has raised questions: Was the hype overdone, or is this just a cautious start for the solar giant?

Why It Matters

- Huge Demand, Weak Start: The IPO’s high subscription didn’t translate into strong listing gains.

- Financials in Focus: Vikram Solar reported a 37% revenue rise and 75% PAT growth in FY25, showing strong fundamentals.

- Sector Tailwinds: With marquee clients like NTPC and Adani Green, and India’s solar energy push, the company remains a long-term growth story.

Expert Take

Analysts believe short-term volatility will continue, as the listing fell below expectations. However, with a strong order book and sectoral demand, Vikram Solar could still prove rewarding for patient investors.

👉 Final Word: The Vikram Solar IPO premium fizzled on Day 1, but the fundamentals are shining. Should you buy now or wait? Read the full detailed analysis here ➝

This post is for informational purposes only.Invest responsibly.No guarantees of results. Seek professional guidance before investing.Consult experts for personalized advice.AI-assisted content, editorially reviewed.See our terms for details.Please note that I am not a SEBI registered investment advisor. The information provided in this article is for informational and educational purposes only and should not be construed as financial advice. Always consult with a qualified and SEBI registered financial professional before making any investment decisions. .Follows Google policies.Not affiliated with Investopedia.com. investopedia.co.in Independent site.