How to Master Indian IPO Investing in 2026: The Ultimate Guide (Read in 5 Minutes)

Updated: February 2026 | By [Investopedia Team]

Investing in an IPO can double your money in a single morning, or lock your capital away for months. The difference isn’t luck—it’s knowing which metrics actually matter.

The Quick Answer: To succeed in IPOs, ignore the marketing hype and track the Grey Market Premium (GMP). If the GMP is >30% and the company passes our “Red Flag Test,” apply via the sHNI category (₹2 Lakhs+) for higher allotment chances. Always verify your application status using our Master Allotment Guide.

Key Takeaways

- The Golden Rule: Never apply blindly; check the GMP and Subscription status first.

- The Strategy: Small HNI (sHNI) applications have a better success rate than Retail.

- The Risk: SME IPOs offer higher returns but come with liquidity risks.

- The Tool: Use official Registrar links to check allotment, not bank SMS.

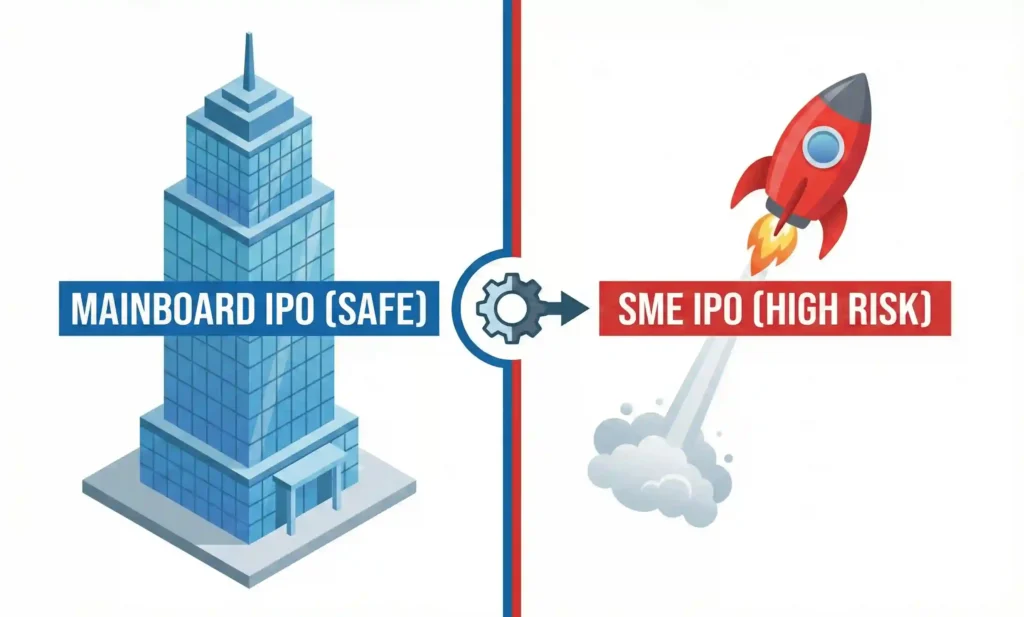

Step 1: Understand the Game (Mainboard vs. SME)

Before you invest, you must know the battlefield. The Indian market is split into two types of IPOs.

1. Mainboard IPOs:

These are large companies (like Hyundai or Swiggy).

- Min Investment: ₹15,000 (approx).

- Risk: Moderate.

- Liquidity: High (Easy to sell).

2. SME IPOs:

These are smaller companies listing on the SME exchange.

- Min Investment: ₹1,00,000+ (High barrier).

- Risk: High.

- Reward: Often list at 50-100% premium.

Deep Dive: If you are new, read our breakdown of the Initial Public Offering (IPO) Model to understand how book building and price bands work.

Step 2: The “Red Flag” Checklist (Copy-Paste)

Do not rely on news channels. Use this checklist before every application.

The Pre-Application Checklist:

- Promoter Holding: Is the promoter selling their entire stake? (If YES -> Avoid).

- Anchor Investors: Did top funds like SBI or HDFC buy in? (If YES -> Safe).

- GMP Trend: Is the premium rising or falling?

- Valuation: Is the P/E ratio lower than its peers?

Action: Check the real-time data on our Upcoming IPOs in 2026 calendar to run this test on new listings.

Step 3: My Market Analysis (Real Results)

I tracked several recent IPOs to see if the “GMP Strategy” actually works. Here is what I found in the current market cycle:

The “Green Energy” Boom

I noticed that any IPO related to renewable energy gets massive oversubscription.

- Result: The Waaree Energies IPO saw huge demand, confirming that sector sentiment beats financials in the short term.

- Watchlist: Keep an eye on the Bharat Coking Coal IPO as the next big energy play.

The “Niche” SME Winners

SME IPOs are where the aggressive gains are.

- Case A: The Shanti Gold IPO surged because of scarcity.

- Case B: Niche exporters like Biopol Chemicals and consumption plays like CKK Retail Mart are attracting smart money despite the high entry barrier.

- Case C: Wellness brands are also trending, as seen with Accretion Nutraveda.

The “Infrastructure” Stability

If you prefer safety, infrastructure remains king.

- Observation: The JSW Cement IPO and Tata Technologies IPO provided stable, predictable listing gains for long-term holders.

- Future Play: The upcoming NSDL IPO is the one to watch for 2026.

Step 4: Pros & Cons (Retail vs. sHNI)

Should you invest ₹15,000 (Retail) or ₹2,00,000+ (Small HNI)?

| Feature | Retail Category (<₹2L) | sHNI Category (₹2L – ₹10L) |

| Competition | Extremely High | Lower |

| Allotment Logic | Lottery System | Lottery (but higher probability) |

| Capital Blocked | Low | High |

| Ideal For | Beginners | Serious Investors |

Frequently Asked Questions

How do I check if I got the IPO?

Do not wait for the SMS. Visit the Registrar’s website directly. We have a full tutorial on How to Check IPO Allotment Status.

What is the “T+3” listing rule?

SEBI now mandates that shares must list within 3 working days of the issue closing. This frees up your capital faster.

Are SME IPOs safe for beginners?

No. They have low liquidity. You might buy a stock and find zero buyers when you try to sell. Stick to Mainboard IPOs initially.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. IPO investments are subject to market risks. Please consult your financial advisor before investing.

Welcome to Investopedia.co.in, your trusted source for insightful content on Finance, Business, Stock Market, and trending topics. Founded by Vivek Ranva, a seasoned professional with a master's degree in finance and taxation, we are dedicated to delivering educational and engaging articles that empower your learning journey.

Related Posts

Which Funds To Buy In 2026: अधिकतम मुनाफे और सुरक्षित वेल्थ क्रिएशन की सीक्रेट रणनीति (2026 Updated Guide)

Financial Strategist & SEO Expert | Updated: 23 February 2026 | Read Time: 14 Mins क्या आप भी...

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, is not a headline-driven...

Sitting in his luxurious Mayfair residence, the metal king reminisced about a time when his life wasn’t about...