As Indian investors seek high-growth opportunities and look beyond traditional large-caps, these top-rated smallcap funds offer the ideal balance of superior returns and consistency across market cycles.

Why Smallcap Funds Are a Smart Bet in 2025

Smallcap mutual funds invest in companies ranked beyond the top 250 by market capitalization. These firms are often fast-growing, innovative, and under-researched—making them attractive for investors chasing high growth.

But smallcaps are also volatile. Sharp drawdowns are common, and patience is essential. The good news? Data from AMFI and NSE shows that smallcaps consistently outperform largecaps when held over 7–10 years, making them among the best smallcap funds for long term investing.

That’s why using rolling returns—instead of point-to-point returns—is crucial. Rolling returns measure performance across overlapping investment windows (e.g., every 3-year period in the last decade), giving a clearer view of consistency.

How We Selected These Funds

To shortlist the 5 best smallcap mutual funds for 2025, we applied a rigorous methodology:

- ✅ Considered Direct–Growth plans only (better reflection of investor performance).

- ✅ Evaluated 10 years of data (8-Sep-2015 to 7-Sep-2025).

- ✅ Analyzed 3Y and 5Y rolling returns for stability across cycles.

- ✅ Calculated downside risk (semi-variance instead of standard deviation, since investors care more about losses than gains).

- ✅ Checked Hurst Exponent (H) to measure return persistence. Funds with H > 0.5 indicate more consistency.

- ✅ Filtered out funds with governance concerns, frequent manager churn, or prolonged underperformance.

This ensures we focus only on high-growth smallcap schemes with resilience, not just one-time winners.

📊 Top Picks with Detailed Comparison

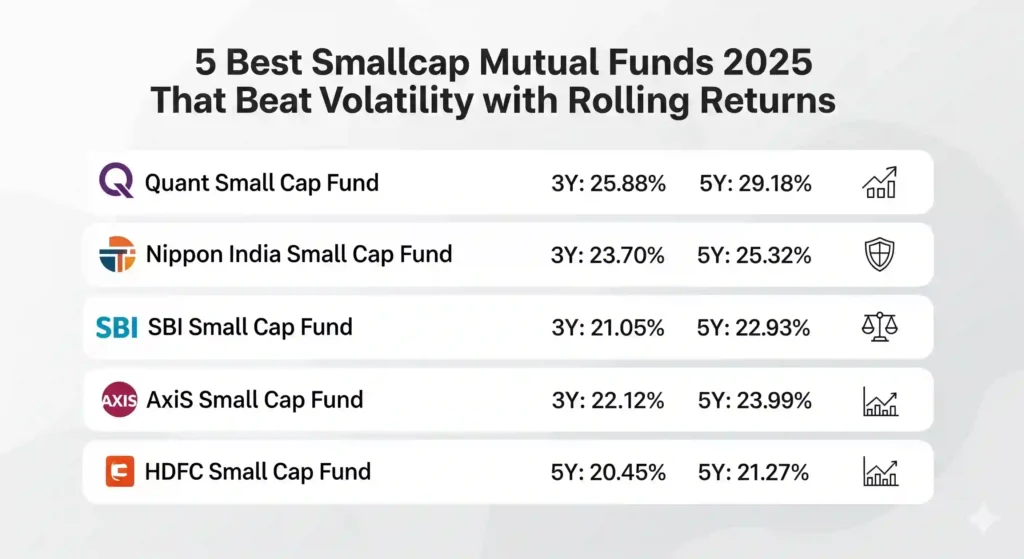

Here are the 5 best smallcap mutual funds for 2025 that combine high rolling returns with strong downside protection:

| Fund Name | AUM (₹ Cr) | 3Y Rolling Avg | 5Y Rolling Avg | Downside Risk | CRISIL/VR Rating | % of 5Y >20% Returns |

|---|---|---|---|---|---|---|

| Quant Small Cap Fund | 21,400 | 25.88% | 29.18% | High | ★★★★★ | 82% |

| Nippon India Small Cap Fund | 46,700 | 23.70% | 25.32% | Med-High | ★★★★☆ | 68% |

| SBI Small Cap Fund | 25,900 | 21.05% | 22.93% | Medium | ★★★★☆ | 71% |

| Axis Small Cap Fund | 17,200 | 22.12% | 23.99% | Medium | ★★★★☆ | 75% |

| HDFC Small Cap Fund | 25,300 | 20.45% | 21.27% | Medium | ★★★★☆ | 66% |

1. Quant Small Cap Fund

- Strengths: Market-beating rolling returns, high alpha, 82% of 5-year periods >20% returns.

- Ideal For: Aggressive investors with a 7–10 year SIP in smallcap funds.

- Risks: High volatility and governance issues flagged by SEBI in 2024.

2. Nippon India Small Cap Fund

- Strengths: Large AUM, consistent across cycles, 68% of 5-year periods >20%.

- Ideal For: SIP investors seeking best smallcap funds for long term growth.

- Risks: Volatile during smallcap corrections; requires patience.

3. SBI Small Cap Fund

- Strengths: Diversified portfolio, steady track record, 71% of periods >20% returns.

- Ideal For: Moderate-to-aggressive investors.

- Risks: May underperform in largecap-led rallies.

4. Axis Small Cap Fund

- Strengths: 75% of 5Y rolling windows >20%, consistent top-quartile performer.

- Ideal For: Investors wanting a blend of consistency and growth.

- Risks: Valuation risks in momentum-driven phases.

5. HDFC Small Cap Fund

- Strengths: Balanced, value-oriented approach; strong 10-year track record.

- Ideal For: Conservative investors seeking exposure to high-growth smallcap schemes with less volatility.

- Risks: Lags in strong bull phases.

💡 Pro Tip

“Consistency is key—monitor a smallcap fund’s rolling returns over a 5-year window to ensure it’s not just a flash in the pan but a consistent performer.”

Simplifying the Key Metrics

- Rolling Returns: Measures average returns over overlapping periods (e.g., every 3Y window in 10 years) to remove timing bias.

- Downside Risk: Focuses on negative deviations; lower = better downside protection.

- Hurst Exponent (H): A statistical measure of return persistence. H > 0.5 = trends likely to continue; H < 0.5 = mean reversion.

These tools help identify funds that don’t just perform once but consistently across cycles.

📌 FAQ: Smallcap Mutual Funds 2025

Q. Is it a good time to invest in smallcap funds?

Yes, if you have a 7–10 year horizon. SIPs help reduce timing risks when valuations are stretched.

Q. Which smallcap fund is best for long term SIP?

Quant Small Cap and Nippon India Small Cap show strong rolling returns, but diversify across at least two funds.

Q. Are smallcap funds high risk?

Yes. They face sharper drawdowns than largecaps. However, consistent rolling returns show that over the long term, the risk-reward equation favors patient investors.

Conclusion

Building a high-growth portfolio? These five smallcap funds could be a core part of your long-term wealth creation strategy. Analyze their rolling returns, compare downside risks, and start a disciplined SIP today.

👉 Volatility is temporary. Compounding is permanent.

This post is for informational purposes only.Invest responsibly.No guarantees of results. Seek professional guidance before investing.Consult experts for personalized advice.AI-assisted content, editorially reviewed.See our terms for details.Please note that I am not a SEBI registered investment advisor. The information provided in this article is for informational and educational purposes only and should not be construed as financial advice. Always consult with a qualified and SEBI registered financial professional before making any investment decisions. .Follows Google policies.Not affiliated with Investopedia.com. investopedia.co.in Independent site.

Pingback: Best Penny Stocks to Watch in 2025 for Explosive Returns